If you’re a dropshipper with product suppliers in China and clients in the USA, you need to know if your products are subject to import duty from China to USA.

Even though the end-customers cover the customs fees from China to USA, you as a dropshipper have the moral obligation to inform your buyers in advance.

So, are your products imported from China subject to import duty in the USA? And if yes, how much will your customers pay? Thisguide on import duty from China to USA will give you all the answers.

What Is Import Duty from China to USA?

Import duty from China to the USA is a tax the U.S. government charges on goods entering the country. Whenever you import products, you, as the importer, are responsible for paying these duties.

The U.S. Customs and Border Protection (CBP) uses the Harmonized Tariff System (HTS) to determine how much duty you owe. Each product has its own HTS code and corresponding duty rate.

Import duties are calculated based on the customs value of your shipment, which typically includes:

- Product cost (FOB value)

- Shipping (freight) costs

- Insurance

Duty rates vary depending on your HTS classification. Some products have a 0% duty, while others can exceed 30%.

For example:

If you import umbrellas worth $28,000 at a duty rate of 6.5%, your import duty would be: $28,000 × 6.5% = $1,820

Import duty is separate from other fees you may need to pay, such as:

- Harbor Maintenance Fee (HMF)

- Merchandise Processing Fee (MPF)

- State sales or use tax

To estimate your final costs before shipping, you can use online import duty calculators, which provide a quick cost breakdown based on HTS codes and shipment value before making a purchase from China.

Overview of All Import Taxes for Goods from China

When you import products from China into the United States, the final cost involves more than just the product price. The U.S. import system includes several taxes and fees that together determine your “landed cost.”

Below is a clear explanation of the main taxes and fees applied to imports from China, how they work, and when they apply.

1. Customs Duty (Base Import Tax)

Customs duty is the primary tax on imported goods and the foundation of most import cost calculations. It is determined by the HTS (Harmonized Tariff Schedule), which assigns a duty rate to each product category.

The duty rate is applied to the customs value, a combination of:

- The cost of the goods

- Shipping (freight) costs

- Insurance

Duty rates can vary significantly. Some categories, like electronics accessories, may carry a 0% duty. Others, such as textiles, footwear, steel, or wooden products, often fall in the 10–30% range.

Because the HTS system is extremely granular, even a small difference in product material or function can result in a different duty rate. This is why choosing the correct HTS code is so important.

2. Section 301 Tariffs (Additional China Tariffs)

In addition to standard customs duty, many Chinese imports are subject to Section 301 tariffs, extra taxes introduced during the U.S.–China trade dispute and still active in 2026.

These tariffs apply on top of the normal duty rate and can significantly increase total import costs. Most affected categories fall under four “lists,” with additional rates commonly set at 7.5% or 25% depending on the product.

Products frequently affected include:

- Machinery and industrial equipment

- Electronics and electrical components

- Plastics and rubber items

- Furniture and household goods

Because Section 301 measures evolve over time, importers should check the most recent updates before placing large orders.

3. Anti-Dumping (AD) & Countervailing Duties (CVD)

Some products imported from China may face Anti-Dumping (AD) or Countervailing Duties (CVD). These are special penalties imposed when the U.S. government determines that:

- A product is being sold at unfairly low prices (dumping), or

- The Chinese government is subsidizing producers (CVD)

These duties are separate from standard customs duty and can be extremely high, sometimes exceeding 100% of the product value.

Typical high-risk categories include:

- Steel and metal products

- Wooden cabinets and furniture parts

- Solar panels

- Certain chemicals and industrial materials

Dropshippers rarely encounter AD/CVD issues, but wholesale importers must check carefully before committing to large orders.

4. Merchandise Processing Fee (MPF)

The MPF applies to nearly every formal import entry into the U.S. It is calculated as 0.3464% of the product value, but the minimum and maximum limits have been updated for 2025-2026:

- Minimum: $33.58

- Maximum: $651.50

MPF is unavoidable unless the shipment qualifies under specific free trade agreements or the De Minimis rule.

5. Harbor Maintenance Fee (HMF)

HMF applies only to ocean freight shipments entering U.S. ports. It is charged at 0.125% of the shipment value and helps maintain U.S. port infrastructure. Air and express shipments (like FedEx and UPS) are exempt from HMF.

6. Federal Excise Tax

Some products are subject to federal excise tax on top of normal import duties. This applies mainly to:

- Alcoholic beverages

- Tobacco products

- Firearms and ammunition

- Fuel and certain vehicle imports

For most ecommerce products, this tax does not apply, but wholesalers dealing in regulated categories must be aware of it.

7. State Use Tax or Sales Tax

Even after your goods clear customs, your state may charge use tax if the products are imported for business use or resale.

The rate depends on the state (0–9%+), and compliance rules vary, especially if you store goods in fulfillment centers or warehouses.

8. De Minimis Threshold (Section 321 Exemption) – CRITICAL UPDATE

Historically, shipments valued at $800 or less entered the U.S. duty-free. However, as of 2025, the U.S. government has significantly tightened these rules:

- New Restrictions: Goods subject to Section 301 tariffs (which cover about 40% of Chinese imports, including many textiles and electronics) may no longer qualify for the $800 duty-free exemption.

- Increased Scrutiny: CBP now requires 10-digit HTS codes even for small “De Minimis” parcels to prevent undervaluation.

For dropshippers, this means many low-value packages that were previously tax-free may now incur tariffs of 7.5% to 25%.

Impact of the Latest Tariff Regulations Between China and the USA

The trade relationship between China and the United States continues to shape the cost of importing goods in 2026.

Although the sharpest tariff increases began several years ago during the U.S.–China trade dispute, recent policy updates have extended, and in some cases expanded, tariffs on key product categories.

For importers, this means the rules are still changing, and staying updated is essential for protecting profit margins.

Here’s how the latest tariff environment affects businesses sourcing from China today.

1. Section 301 Tariffs Remain in Effect for Many Product Categories

Despite ongoing negotiations, the U.S. has maintained the majority of Section 301 tariffs implemented in previous years. These tariffs apply additional rates of 7.5% or 25% on thousands of Chinese products, covering everything from electronics and industrial equipment to plastic items and furniture.

For importers, especially those operating with thin margins, the continuation of these tariffs means:

- Higher landed costs

- Greater importance of accurate HTS classification

- The need to evaluate alternative suppliers or materials

Many industries hoped for large-scale rollbacks by 2025, but so far the adjustments have been selective rather than broad.

2. Strategic Industry Rate Hikes (2025-2026)

RecentFollowing the 2024 USTR review, tariffs on strategic Chinese goods are increasing sharply through 2026:

- Electric Vehicles: 100%

- Solar Cells & Semiconductors: 50%

- EV Batteries & Critical Minerals: 25%

- Medical Products (Gloves/Syringes): 50% to 100%

While most lightweight consumer goods remain at 7.5% or 25% (Section 301), any products involving steel, aluminum, or lithium-ion components are seeing higher enforcement and costs.

3. More HTS Reclassifications Lead to Unexpected Duty Changes

Every year, the U.S. updates specific HTS codes or reassigns product categories.

In 2026, several updates affected duty rates for:

- Household goods

- Apparel accessories

- Consumer electronics

- DIY tools and equipment

A product that previously fell under a low-duty category may now be classified differently, leading to higher taxes. This is one reason importers increasingly rely on:

- Customs brokers

- Import compliance tools

- Professional HTS classification reviews

The goal is to avoid misclassification, unexpected duty bills, or even shipment delays.

4. Small and Medium Importers Are More Affected Than Large Corporations

Large brands have negotiation power, legal support, and supply-chain alternatives. Small and medium businesses, particularly ecommerce sellers, feel tariff changes more directly.

Recent regulatory updates have influenced:

- MOQ decisions (many importers lowered or split orders to reduce risk)

- Product selection (brands avoid high-tariff categories)

- Shipping routes (some switch to fulfillment centers outside the U.S. first)

- Retail pricing strategies

For ecommerce sellers competing on price, even a 5–10% increase in landed cost can make a product unprofitable.

5. Increased Scrutiny on Misclassification and Undervaluation

With tariffs still in place, the U.S. has increased enforcement efforts.

CBP is paying closer attention to:

- Incorrect HTS codes

- Underreported product values

- Inaccurate product descriptions

- Complex shipments split to avoid tariff thresholds

Penalties for incorrect reporting have risen, and repeat violations can result in delayed shipments or audits.

This makes transparency and accurate documentation more important than ever.

What Products Are Subject to Import Duty?

When importing goods from China to the USA, many items are subject to import duties. These taxes are calculated based on the product’s customs value, including its cost, shipping, and insurance.

Here’s a list of common products that typically incur import duties:

- Electronics (smartphones, laptops, tablets)

- Clothing and textiles

- Furniture and home decor items

- Machinery and industrial equipment

- Toys and sporting goods

- Jewelry and watches

- Automotive parts and accessories

- Kitchenware and appliances

It’s important to note that the specific duty rates can vary widely depending on the product category. For example, the import duty on furniture from China to the USA can range from 0% to 12.5%, depending on the type of furniture.

You should be aware that certain products may be subject to additional tariffs or regulations. These can include items like food products, chemicals, and pharmaceuticals.

Always check the current Harmonized Tariff Schedule for the most up-to-date information on duty rates for specific products.

Remember, if you’re purchasing items from Chinese sellers on platforms like eBay, you’re still responsible for any applicable import duties. The cost of these duties is typically not included in the listed price of the item.

How to Calculate Import Duty from China to USA?

Calculating import duties from China to the USA involves several key steps. Let’s break it down:

HS or HTS Code

The Harmonized Tariff Schedule (HTS) is your key to understanding import duties from China to the USA. It’s a comprehensive system that classifies traded goods and determines their duty rates.

Every product you import has a unique HTS code. This code consists of 10 digits, with the first 6 being the Harmonized System (HS) code. The HS code is internationally standardized, while the last 4 digits are specific to the USA.

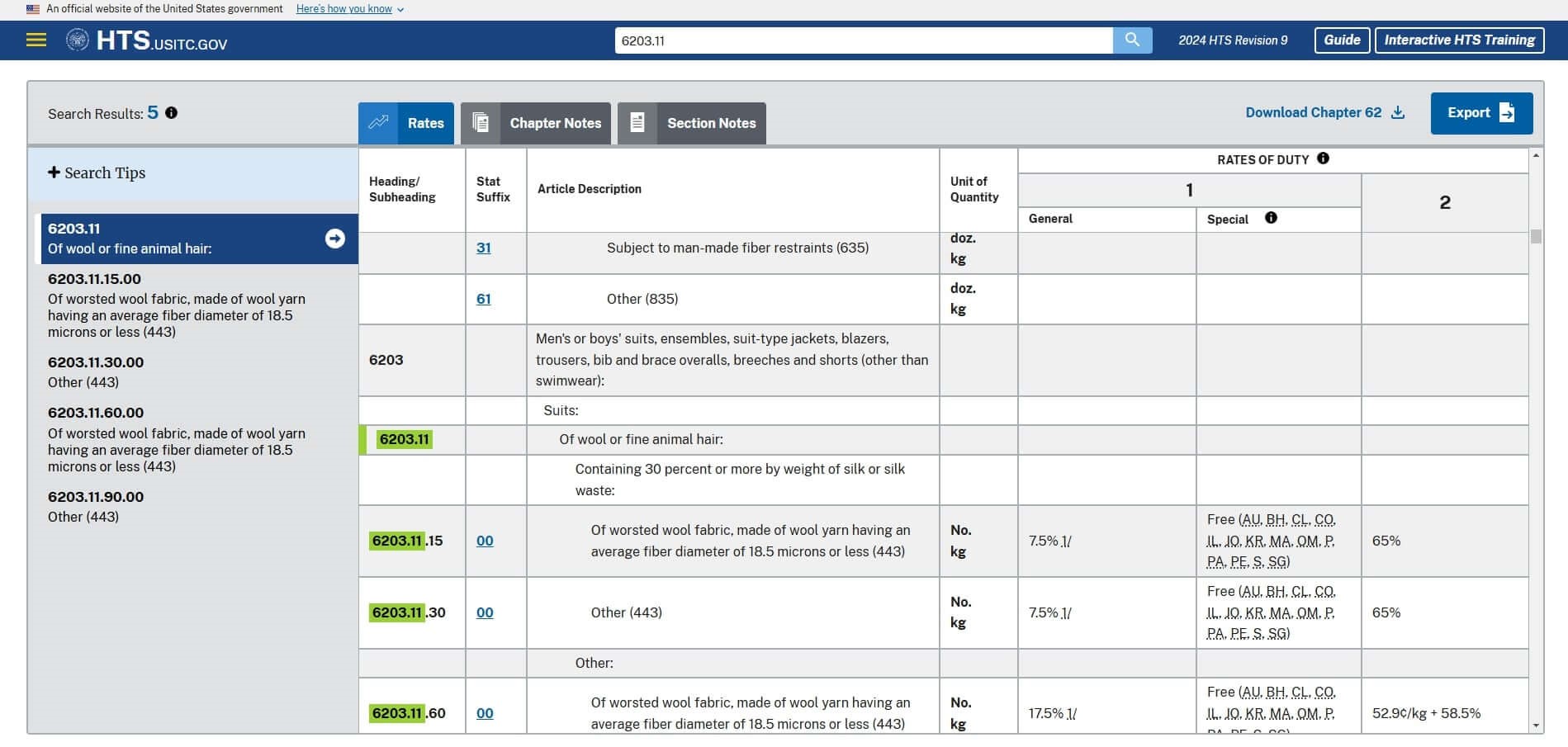

For example, let’s say you’re importing wool suits. You’d need to find the correct HTS code to determine the duty rate. Wool suits typically fall under HTS code 6203.11.

To find your product’s HTS code:

- Visit the official USITC HTS website

- Use the search function or browse categories

- Identify the most specific description matching your product

Remember, accurate classification is crucial. Misclassification can lead to incorrect duty payments and potential legal issues. When in doubt, consult with a customs expert or request a binding ruling from U.S. Customs and Border Protection.

By mastering HTS codes, you’ll navigate import duties more efficiently and potentially save on costs. Keep your HTS codes updated, as they can change annually.

Commercial Value

The commercial value of your imported goods plays a crucial role in calculating import duties from China to the USA. It’s the price you actually paid or will pay for the merchandise when sold for export to the United States.

When determining commercial value, you need to include several factors:

- The actual price of the goods

- Packing costs

- Selling commissions

- Royalties or license fees

You must also factor in shipping and insurance costs when declaring the value to U.S. Customs. This total is known as the “landed cost” and forms the basis for duty calculations.

Accurately assessing and declaring commercial value is vital. Undervaluing goods can lead to penalties, while overvaluing may result in unnecessary duty payments.

To ensure compliance, keep detailed records of all transactions, including invoices, purchase orders, and proof of payment. U.S. Customs may request these documents to verify your declared value.

Import Duty Tariff

Import duty tariffs are taxes you pay when bringing goods into the USA from China. These tariffs directly impact your overall import costs.

The Harmonized Tariff Schedule (HTS) sets the rates for different products. Tariffs vary widely depending on what you’re importing.

For example:

- Umbrellas face a 6.5% duty rate

- Electronics might have tariffs ranging from 0% to 35%

- Certain textiles can see duties as high as 32%

To calculate your duty, you multiply the tariff rate by your product’s customs value. This value includes the cost of goods, shipping, and insurance.

Let’s say you import $10,000 worth of umbrellas. With a 6.5% tariff, you’d pay $650 in import duties.

Remember, these rates can change. The ongoing trade tensions between the US and China have led to additional tariffs on many Chinese goods.

You need to classify your products correctly under the HTS to determine the right duty rate. This process can be complex, and mistakes can be costly.

Always check the latest HTS for current rates. Consider working with a customs broker to ensure accurate classification and duty calculation.

Example Calculation

Let’s say you’re importing fancy water bottles for $2,000 total.

- HTS Code: 3923.30.00 (Tariff: 3%)

- Base Duty: $2,000 * 3% = $60

- Section 301 (if applicable): If these fall under a 25% list, add $500.

- MPF Fee: 0.3464% of $2,000 is $6.93. However, since this is below the legal minimum, you must pay the 2025 minimum MPF of $33.58.

Total estimated import cost (excluding shipping): $60 + $500 + $33.58 = $593.58.

How to Pay Import Duty from China to USA?

Paying import duties from China to the USA involves several methods, each with its own advantages and considerations. You’ll need to choose the option that best suits your business needs and risk tolerance.

Cash in Advance

Cash in advance is a straightforward payment method for import duties. You pay the full amount upfront before receiving the goods. This approach offers the highest level of security for the seller but carries more risk for you as the buyer.

Benefits include faster processing times and potential supplier discounts. The U.S. Customs and Border Protection (CBP) often prefers this method as it ensures immediate duty payment.

To use this method, you’ll need to calculate the exact duty amount based on the commodity code and value of your goods. For example, if you’re importing umbrellas worth $28,000, with a 6.5% duty rate, you’d pay $1,820 in duties.

Remember to factor in additional fees like the Merchandise Processing Fee (MPF) and Harbor Maintenance Fee (HMF) when budgeting for cash in advance payments.

Letter of Credit

A letter of credit (LOC) is a document from a bank guaranteeing that the seller will receive payment in full as long as certain delivery conditions are met. This method balances risk between you and the seller.

LOCs are particularly useful for large transactions or when dealing with new suppliers. They provide security to both parties and can help establish trust in international trade relationships.

To use an LOC, you’ll need to work with your bank to set up the terms. Once all conditions are met, such as proper documentation and timely delivery, the bank will release the funds to pay import duties.

While LOCs offer protection, they can be complex and involve fees from both your bank and the seller’s bank. Make sure to carefully review all terms and conditions before proceeding.

Documentary Collection

Documentary collection is a method where the seller ships the goods and then sends the shipping documents to their bank. The bank forwards these documents to your bank, which will only release them to you upon payment of the import duties.

This method is less expensive than letters of credit but offers less protection. It’s often used when you have an established relationship with the seller and want to reduce transaction costs.

To use documentary collection, you’ll need to arrange payment through your bank once you receive notification that the documents have arrived. You can then use these documents to clear customs and pay the required duties.

Keep in mind that import duties can vary based on the specific products you’re importing. Always check the latest tariff rates and regulations to ensure accurate payments and avoid delays in customs clearance.

How to Reduce Import Duty Legally (Practical Tips)

Import duties are a necessary part of doing business with overseas suppliers, but they don’t have to drain your profit margins.

Experienced importers use a mix of compliance, smart sourcing, and strategic shipping choices to legitimately reduce what they pay.

The key is understanding how the U.S. tariff system works, and where there is room to optimize without risking penalties or delays.

Here are practical, fully legal methods that ecommerce sellers and wholesalers rely on to keep costs under control.

1. Choose the Correct HTS Code, It Can Change Your Entire Duty Rate

Many products can reasonably fit into more than one HTS classification, and each code carries its own duty percentage.

A small change in how you describe your product, its material, function, or intended use, can shift it into a lower-duty category.

For example:

- A plastic storage item may fall under a household goods code with a duty rate of 3–5%,

- But if classified under a different category (e.g., office supplies or industrial use), the rate could be much lower.

This is why experienced importers often:

- Ask suppliers for their recommended HTS code

- Verify it through a customs broker

- Compare alternatives when borderline classifications exist

- Request an official binding ruling from CBP for uncertain cases

Correct classification is the easiest and most powerful way to reduce duty costs, and it’s completely legal.

2. Use the De Minimis Rule (Section 321) for Direct-to-Consumer Shipments

Under Section 321, goods valued at $800 or less can enter the U.S. duty-free, as long as the shipment is addressed to the final customer.

This rule became a cornerstone for many dropshipping operations because:

- No duty

- No MPF

- Significantly faster clearance times

However, it only applies if:

- Each shipment is under the $800 threshold

- You aren’t splitting a single order into multiple parcels to avoid duties

- The goods ship directly to the end consumer

For lightweight, high-turnover consumer goods, Section 321 is one of the most effective legal mechanisms to avoid import duty entirely.

3. Consider Alternative Materials or Product Variations

Tariff rates often depend on what a product is made from, not just what it does.

A few examples:

- Wooden furniture vs. metal furniture

- Leather goods vs. PU or fabric alternatives

- Plastic items vs. rubber or composite materials

If two versions of your product serve the same purpose but fall under different duty rates, switching materials can meaningfully reduce your landed cost — sometimes by double-digit percentages.

This is one of the reasons many ecommerce sellers redesign products with tariff-friendly materials.

4. Ship Through Fulfillment Centers in Countries with Favorable Trade Terms

Some importers route inventory through countries like:

- Mexico

- Canada

- Vietnam

- South Korea

These countries have different trade agreements or tariff structures. While this doesn’t automatically eliminate duty, it can open the door to:

- Lower processing fees

- Preferential trade categories

- Alternative sourcing options

- Multi-country supply chains that dodge high China-specific tariffs

Note: This must be done transparently, relabeling Chinese goods as originating in another country without substantial transformation is illegal. But legitimate multi-country manufacturing is a common strategy.

5. Take Advantage of First Sale Rule (When Applicable)

The First Sale Rule allows importers to calculate duty based on the manufacturer’s price, not the final price paid to a middleman.

This is relevant when:

- There are multiple parties in the supply chain

- A trading company buys from a factory and resells to you

If conditions are met and documentation is properly maintained, you can legally pay duty on a lower declared value.

This rule is widely used by large retailers and is available to smaller importers who maintain clear records.

Frequently Asked Questions

What Is the Difference between Import Duty, Tariff and VAT?

Although these terms are often used together, they refer to different types of taxes:

Import Duty

Import duty is the base tax charged by U.S. Customs when goods enter the country. It’s calculated using the HTS duty rate and the customs value (product cost + freight + insurance). Every country has import duties, and the rate depends on the product category.

Tariff

A tariff is an additional tax applied on top of the import duty, usually for trade or political reasons. For U.S.–China trade, Section 301 tariffs are the most common example. They apply extra percentages, such as 7.5% or 25%, to specific Chinese goods, even if their base duty is low.

All tariffs are import duties, but not all import duties are tariffs.

VAT (Value-Added Tax)

VAT is a consumption tax charged in many countries (e.g., EU, UK). The United States does not charge VAT on imports.

However, U.S. importers may still owe state sales tax or use tax after the goods enter the country, this is separate from customs duty and tariffs.

Who Pays Import Duty When Using a Freight Forwarder?

Even when you use a freight forwarder, the importer of record (IOR) is the one responsible for paying import duties. In most cases, you, the buyer, are the importer of record, not the supplier and not the freight forwarder.

Here’s how it works:

- A freight forwarder can handle the paperwork, submit customs declarations, and advance the payment on your behalf.

- But legally, the duty is your obligation, because you own the goods when they enter the United States.

- After clearing customs, the forwarder will bill you for any duties, tariffs, MPF/HMF fees, and service charges they paid upfront.

The only exception is when you’re using a service like DDP (Delivered Duty Paid), where the seller agrees to cover duty and taxes. This is uncommon for U.S. imports from China and usually comes with a higher shipping cost.

What Situation Can Exempt Duty?

Certain situations may qualify for duty exemption:

- Personal goods valued under $800 (de minimis threshold)

- Samples for soliciting orders

- Goods for repair or alteration to be re-exported

- Temporary imports for trade shows or exhibitions

Remember, exemptions are subject to specific conditions and documentation requirements. Always verify current regulations with U.S. Customs and Border Protection for accurate information.

What Happens If I Don’t Pay Import Taxes?

If import taxes aren’t paid, your shipment will not be released by U.S. Customs. The goods may be held, returned to the sender, or even seized.

Customs may also issue penalties, delays, or additional inspections on future shipments.

In short, your goods won’t move forward until all duties and fees are paid.

Summing Up: Strategies for Handling Import Duty from China to USA

Importing from China is still one of the most profitable ways to build a product-based business in the U.S., but understanding how duties, tariffs, and fees work is essential.

When you know how costs are calculated, and how to optimize them legally, you can protect your margins, price your products confidently, and avoid surprises at the border.

If you’re planning your next shipment, having the right sourcing partner can make the entire process smoother, faster, and far more cost-efficient.

Ready to start importing? Request a sourcing quote to get expert assistance with your product sourcing needs. Our professional help at NicheDropshipping can save you time, reduce errors, and potentially lower your import costs.

So insightful! Any idea how this would work if sending from China to Canada?

Hello Ian,

Thanks for your interest. Feel free to ask for the contact info through this page:https://nichedropshipping.com/niche-dropshipping/. Our colleague will answer your question. Looking forward to your message.