If you’re a dropshipper with product suppliers in China and clients in the USA, you need to know if your products are subject to import duty from China to USA.

Even though the end-customers cover the customs fees from China to USA, you as a dropshipper have the moral obligation to inform your buyers in advance.

So, are your products imported from China subject to import duty in the USA? And if yes, how much will your customers pay? This ultimate FAQ guide on import duty from China to USA will give you all the answers.

So, let’s find out!

Key Takeaways

- Import duties from China to USA vary based on product type and value.

- Accurate HTS code classification is essential for determining correct duty rates.

- Importers must factor in duties when calculating total import costs for profitability.

What Is Import Duty from China to USA?

Import duty from China to USA is a tax imposed on goods you bring into the United States from China. When you import products, you’re responsible for paying these taxes to the U.S. government.

The U.S. Customs and Border Protection (CBP) oversees the collection of import duties. They use the Harmonized Tariff System (HTS) to determine the correct duty rate for each item.

Import duties are calculated based on the customs value of your goods. This includes:

- Cost of the products

- Shipping fees

- Insurance costs

The specific duty rate depends on the product classification under the HTS. Rates can vary widely, from 0% to over 30% in some cases.

For example, if you import umbrellas costing $28,000, you might pay a 6.5% duty rate. This would result in $1,820 in import duties.

It’s important to note that import duties are separate from other fees like:

- Harbor maintenance fees

- Merchandise processing fees

- Sales tax

To accurately calculate your import duties, you can use online import duty calculators. These tools help you estimate costs before making purchases from China.

How to Calculate Import Duty from China to USA?

Calculating import duties from China to the USA involves several key steps. Let’s break it down:

HS or HTS Code

The Harmonized Tariff Schedule (HTS) is your key to understanding import duties from China to the USA. It’s a comprehensive system that classifies traded goods and determines their duty rates.

Every product you import has a unique HTS code. This code consists of 10 digits, with the first 6 being the Harmonized System (HS) code. The HS code is internationally standardized, while the last 4 digits are specific to the USA.

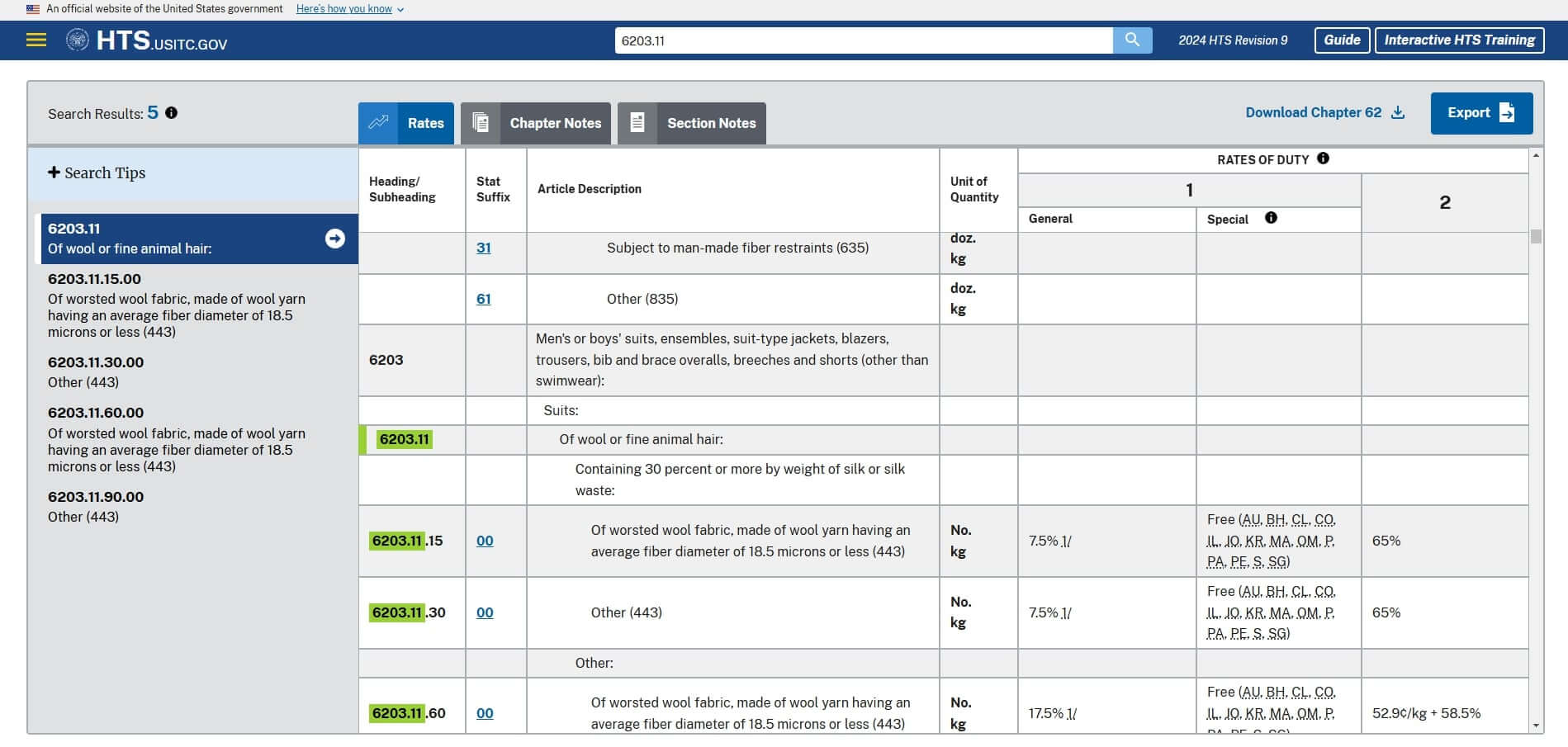

For example, let’s say you’re importing wool suits. You’d need to find the correct HTS code to determine the duty rate. Wool suits typically fall under HTS code 6203.11.

To find your product’s HTS code:

- Visit the official USITC HTS website

- Use the search function or browse categories

- Identify the most specific description matching your product

Remember, accurate classification is crucial. Misclassification can lead to incorrect duty payments and potential legal issues. When in doubt, consult with a customs expert or request a binding ruling from U.S. Customs and Border Protection.

By mastering HTS codes, you’ll navigate import duties more efficiently and potentially save on costs. Keep your HTS codes updated, as they can change annually.

Commercial Value

The commercial value of your imported goods plays a crucial role in calculating import duties from China to the USA. It’s the price you actually paid or will pay for the merchandise when sold for export to the United States.

When determining commercial value, you need to include several factors:

- The actual price of the goods

- Packing costs

- Selling commissions

- Royalties or license fees

You must also factor in shipping and insurance costs when declaring the value to U.S. Customs. This total is known as the “landed cost” and forms the basis for duty calculations.

Accurately assessing and declaring commercial value is vital. Undervaluing goods can lead to penalties, while overvaluing may result in unnecessary duty payments.

To ensure compliance, keep detailed records of all transactions, including invoices, purchase orders, and proof of payment. U.S. Customs may request these documents to verify your declared value.

Import Duty Tariff

Import duty tariffs are taxes you pay when bringing goods into the USA from China. These tariffs directly impact your overall import costs.

The Harmonized Tariff Schedule (HTS) sets the rates for different products. Tariffs vary widely depending on what you’re importing.

For example:

- Umbrellas face a 6.5% duty rate

- Electronics might have tariffs ranging from 0% to 35%

- Certain textiles can see duties as high as 32%

To calculate your duty, you multiply the tariff rate by your product’s customs value. This value includes the cost of goods, shipping, and insurance.

Let’s say you import $10,000 worth of umbrellas. With a 6.5% tariff, you’d pay $650 in import duties.

Remember, these rates can change. The ongoing trade tensions between the US and China have led to additional tariffs on many Chinese goods.

You need to classify your products correctly under the HTS to determine the right duty rate. This process can be complex, and mistakes can be costly.

Always check the latest HTS for current rates. Consider working with a customs broker to ensure accurate classification and duty calculation.

Example Calculation

If you have the above details, apply this formula to obtain your import duty:

Import Duty = Product Value x Import Duty Tariff

Let’s say you’re importing fancy water bottles for $2000 total.

The HTS code for this product would be 3923.30.00 (Carboys, bottles, flasks, and similar articles).

Next, we can go to either the USITC website or Freightos, search the code, and you’ll see that this product’s tariff is 3%.

Now, we can calculate the import duty fee:

$2000 * 3% = $60

What Are the Products Subject to Import Duty?

When importing goods from China to the USA, many items are subject to import duties. These taxes are calculated based on the product’s customs value, including its cost, shipping, and insurance.

Here’s a list of common products that typically incur import duties:

- Electronics (smartphones, laptops, tablets)

- Clothing and textiles

- Furniture and home decor items

- Machinery and industrial equipment

- Toys and sporting goods

- Jewelry and watches

- Automotive parts and accessories

- Kitchenware and appliances

It’s important to note that the specific duty rates can vary widely depending on the product category. For example, the import duty on furniture from China to the USA can range from 0% to 12.5%, depending on the type of furniture.

You should be aware that certain products may be subject to additional tariffs or regulations. These can include items like food products, chemicals, and pharmaceuticals.

Always check the current Harmonized Tariff Schedule for the most up-to-date information on duty rates for specific products.

Remember, if you’re purchasing items from Chinese sellers on platforms like eBay, you’re still responsible for any applicable import duties. The cost of these duties is typically not included in the listed price of the item.

Why Should You Pay Import Duty?

Import duties play a crucial role in international trade and domestic economies. They serve multiple purposes beyond just generating revenue for governments. Let’s explore the key reasons why paying import duties is essential.

Revenue Generation

Import duties are a significant source of income for governments. When you import goods from China to the USA, the customs duties you pay contribute directly to the national budget. In 2023, the U.S. government collected over $100 billion in customs duties.

This revenue helps fund various public services and infrastructure projects. Schools, hospitals, and roads benefit from these funds. By paying import duties, you’re indirectly supporting your country’s development and social programs.

Import duties also help balance trade deficits. They encourage domestic production by making imported goods more expensive. This can lead to job creation and economic growth within your country.

Product Safety

Import duties help ensure the safety and quality of products entering your country.

Part of the revenue generated from these duties goes towards funding regulatory agencies like the Food and Drug Administration (FDA) and Consumer Product Safety Commission (CPSC).

These agencies conduct inspections and tests on imported goods, checking for compliance with U.S. safety standards and regulations. For example, the CPSC inspects children’s toys from China for lead content and choking hazards.

By paying import duties, you’re supporting these crucial safety measures. This helps protect consumers from potentially harmful or substandard products. It’s especially important for goods like electronics, food items, and pharmaceuticals.

Fair Trade

Import duties promote fair trade practices and protect domestic industries. They help level the playing field between domestic and foreign producers.

This is particularly important when dealing with countries that may have lower production costs or different labor standards.

When you pay import duties on Chinese goods, you help offset potential advantages foreign manufacturers might have. These include lower labor costs or less stringent environmental regulations.

For instance, the 25% duty rate on many Chinese imports helps U.S. manufacturers compete more effectively. It encourages fair competition and prevents the flooding of markets with artificially cheap goods.

Import duties also discourage harmful trade practices like dumping. This is when foreign companies sell products below cost to gain market share. By imposing duties, your government can protect local businesses and jobs from unfair competition.

How to Pay Import Duty from China to USA?

Paying import duties from China to the USA involves several methods, each with its own advantages and considerations. You’ll need to choose the option that best suits your business needs and risk tolerance.

Cash in Advance

Cash in advance is a straightforward payment method for import duties. You pay the full amount upfront before receiving the goods. This approach offers the highest level of security for the seller but carries more risk for you as the buyer.

Benefits include faster processing times and potential supplier discounts. The U.S. Customs and Border Protection (CBP) often prefers this method as it ensures immediate duty payment.

To use this method, you’ll need to calculate the exact duty amount based on the commodity code and value of your goods. For example, if you’re importing umbrellas worth $28,000, with a 6.5% duty rate, you’d pay $1,820 in duties.

Remember to factor in additional fees like the Merchandise Processing Fee (MPF) and Harbor Maintenance Fee (HMF) when budgeting for cash in advance payments.

Letter of Credit

A letter of credit (LOC) is a document from a bank guaranteeing that the seller will receive payment in full as long as certain delivery conditions are met. This method balances risk between you and the seller.

LOCs are particularly useful for large transactions or when dealing with new suppliers. They provide security to both parties and can help establish trust in international trade relationships.

To use an LOC, you’ll need to work with your bank to set up the terms. Once all conditions are met, such as proper documentation and timely delivery, the bank will release the funds to pay import duties.

While LOCs offer protection, they can be complex and involve fees from both your bank and the seller’s bank. Make sure to carefully review all terms and conditions before proceeding.

Documentary Collection

Documentary collection is a method where the seller ships the goods and then sends the shipping documents to their bank. The bank forwards these documents to your bank, which will only release them to you upon payment of the import duties.

This method is less expensive than letters of credit but offers less protection. It’s often used when you have an established relationship with the seller and want to reduce transaction costs.

To use documentary collection, you’ll need to arrange payment through your bank once you receive notification that the documents have arrived. You can then use these documents to clear customs and pay the required duties.

Keep in mind that import duties can vary based on the specific products you’re importing. Always check the latest tariff rates and regulations to ensure accurate payments and avoid delays in customs clearance.

Frequently Asked Questions

Import duties from China to the USA involve complex regulations and calculations. Understanding key aspects like duty types, payment responsibility, and potential exemptions can help importers navigate the process more effectively.

What Is the Difference between Import Duty and VAT?

Import duty is a tax levied on goods entering a country, while VAT (Value Added Tax) is applied to domestic goods and services. The USA doesn’t have a VAT system. Instead, it uses import duties and tariffs for imported goods.

Import duties are calculated based on the product’s customs value, including cost, shipping, and insurance. VAT, where applicable, is typically charged on the total value of goods plus import duties.

Who Pays Import Duty?

The end-customer covers the import duty from China to USA for products over $800. Either the customs authorities or the carrier will inform the customer if their product is subject to taxes.

Dropshippers, as well as suppliers or dropshipping agents, have nothing to do with the import customs process.

However, if you’re a dropshipper and owner of an eCommerce store, it’s always best to inform your customers if the products bought for you are subject to import duty.

To do that, you can create a separate policy page on your website, send them an email confirmation with the info, or even place a message on your checkout page.

The extra import duty costs shouldn’t come as a surprise, as this will make you lose customer loyalty. So, it’s always better to inform and prepare your customers upfront.

If you wish to make it even more convenient for your customers, you can embed an import duty calculator on your website or at least point them to a website where they can check, such as Freightos.

What Factors Influence the Customs Duty Rate for US Imports from China?

Several factors affect the customs duty rate for imports from China:

- Product classification under the Harmonized Tariff Schedule (HTS)

- Country of origin

- Trade agreements or special programs

- Value of the imported goods

The specific duty rate can range from 0% to over 30%, depending on these factors. Check the HTS to determine the applicable rate for your products.

How to Reduce Import Duty Costs?

You can minimize import duty costs through several strategies:

- Accurately classify your goods to avoid overpayment.

- Consider Free Trade Agreements if applicable.

- Use bonded warehouses for temporary storage.

- Explore duty drawback programs for exported goods.

Consulting with a customs broker can help you identify the most effective cost-reduction methods for your specific situation.

What Situation Can Exempt Duty?

Certain situations may qualify for duty exemption:

- Personal goods valued under $800 (de minimis threshold)

- Samples for soliciting orders

- Goods for repair or alteration to be re-exported

- Temporary imports for trade shows or exhibitions

Remember, exemptions are subject to specific conditions and documentation requirements. Always verify current regulations with U.S. Customs and Border Protection for accurate information.

Summing Up: Strategies for Handling Import Duty from China to USA

Navigating import duties from China to the USA can be complex, but understanding the basics is crucial for successful eCommerce operations. Remember, duty rates vary based on product classification and can significantly impact your costs.

Stay informed about current tariff rates and regulations to avoid surprises. Accurate product classification is key to determining the correct duty rate. Don’t forget additional fees like Merchandise Processing Fee and Harbor Maintenance Fee.

Consider working with customs brokers or freight forwarders to ensure compliance and streamline the import process. They can help you navigate the intricacies of customs procedures and documentation.

Ready to start importing? Request a sourcing quote to get expert assistance with your product sourcing needs. Our professional help at NicheDropshipping can save you time, reduce errors, and potentially lower your import costs.

By staying informed and seeking expert guidance, you can master the complexities of import duties and build a successful cross-border business.

So insightful! Any idea how this would work if sending from China to Canada?

Hello Ian,

Thanks for your interest. Feel free to ask for the contact info through this page:https://nichedropshipping.com/niche-dropshipping/. Our colleague will answer your question. Looking forward to your message.